After filing of GSTR-1 (details of outward supplies), the taxpayers should file GSTR-2.

GSTR-2

is a return containing details of all inward supplies. Based on this

return the Input Tax Credit that a taxpayer is eligible to avail is

determined.

After your suppliers file GSTR-1, the details of your inward supplies get auto-populated in GSTR-2A.

All the purchases from GSTR-2A are considered as inward supplies for you.

Hence, only details of purchases

from unregistered dealers and purchases not reflecting in GSTR-2A have

to be entered while filing GSTR-2.

Here is a step-by-step process of filing GSTR-2:

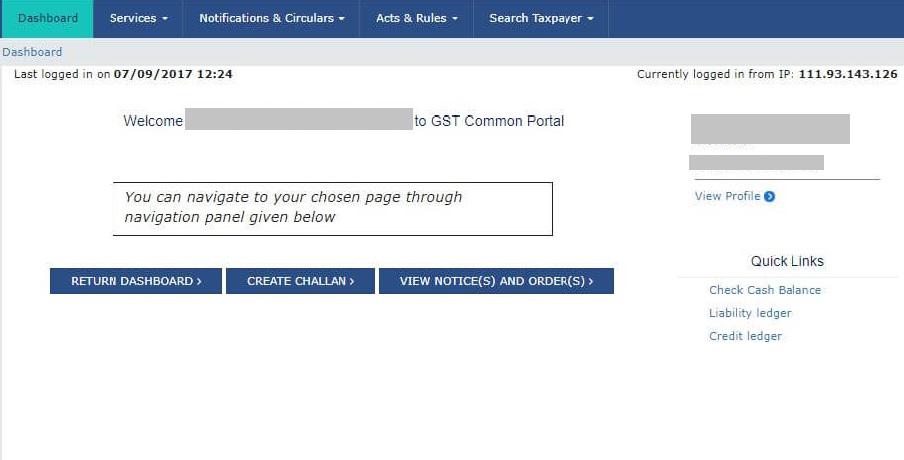

1. Login to GST Portal

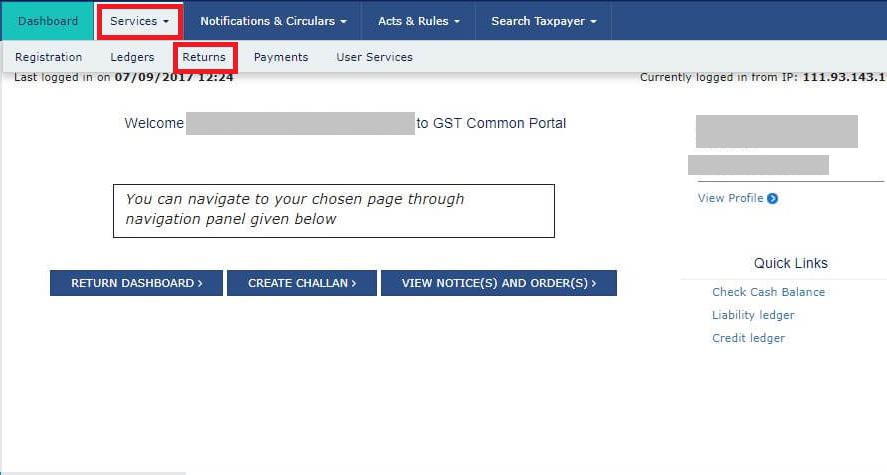

2. Go to Services > Returns

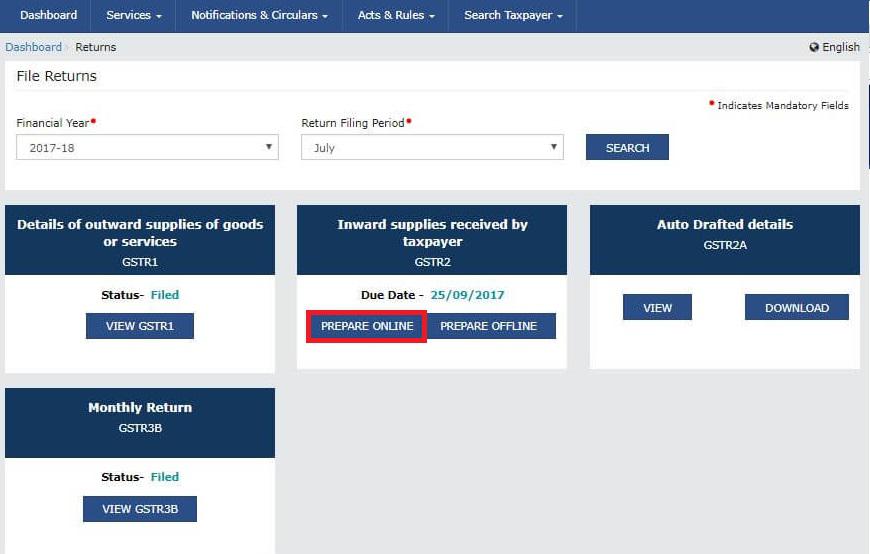

3. Select the month for which you are filing GSTR-2

4. Click on Prepare Online under GSTR-2

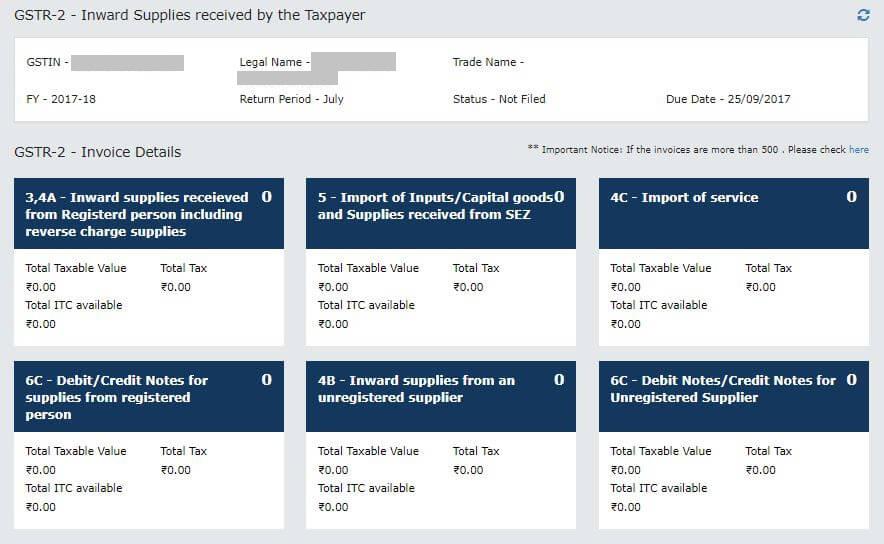

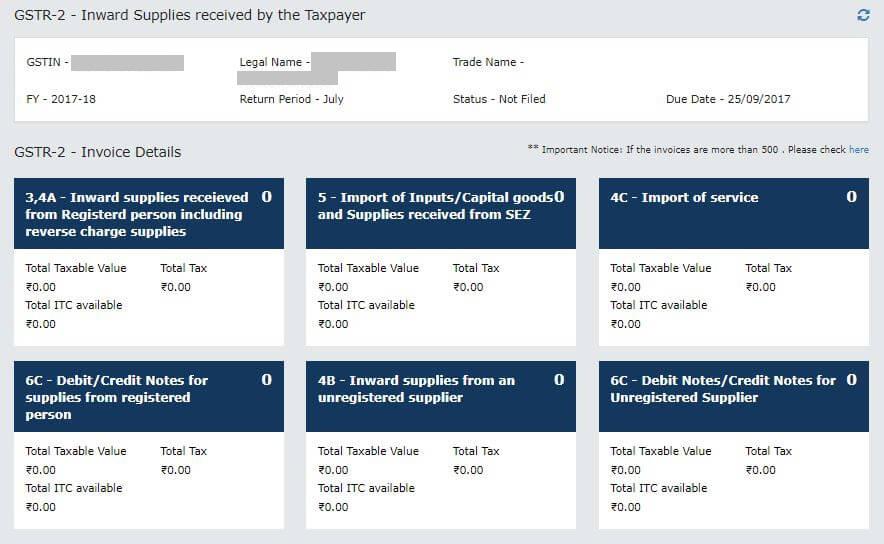

5. Here you will 11 tiles containing all the details that need to be filled in

Do note that only those details that are

not auto-populated in your GSTR-2A or the details that have to be

changed should be entered in these tiles.

GSTR-2 – Invoice Details

1. 3, 4A – Inward supplies received from Registered person including Reverse Charge supplies:

Details of all missing inward supplies from registered dealers should be entered here. This will also include inward supplies liable for reverse charge.

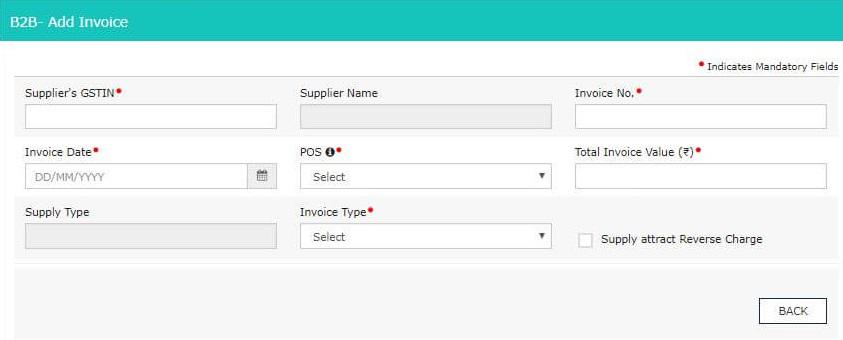

Step 1 – Click on ‘ADD

MISSING INVOICE DETAILS’ to add details of any inward supplies from a

registered person and reverse charge supplies missing in GSTR-2A.

Step 2 – Enter the following details:

- GSTIN of the Supplier

- Invoice Number, Invoice Date, Total Invoice Value

- Select state in which the sale is made

- In Invoice Type select – B2B, Deemed Exports, SEZ Supplies with or without payment

Step 3 – Click on ‘Add Details’.

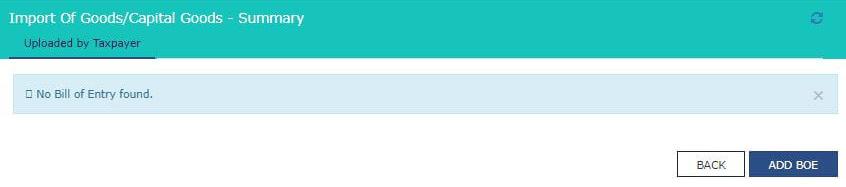

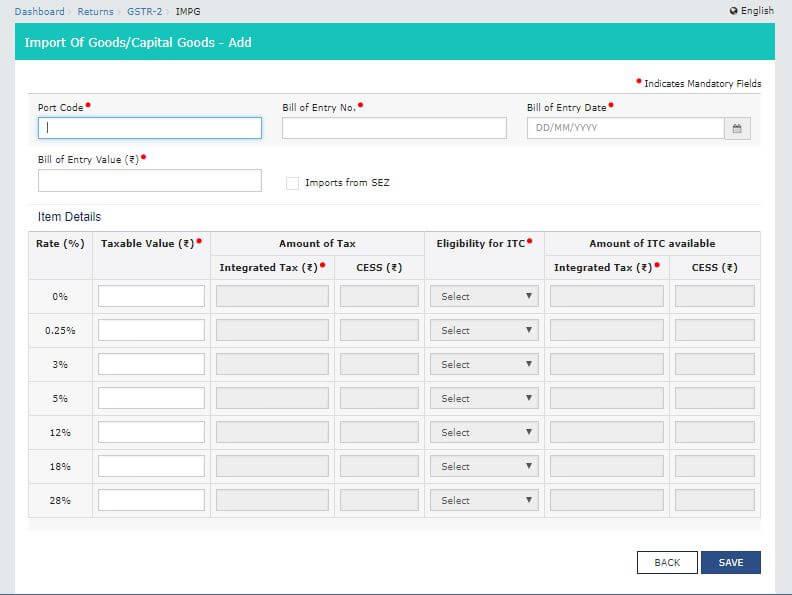

2. 5 – Import of Inputs/ Capital Goods and Supplies received from SEZ:

Any import of Inputs and Capital Goods including goods received from SEZ should be entered in this tile:

Step 1 – Click on ‘ADD BOE’.

Step 2 – Enter these details:

- Port Code of the place from where import is made

- Bill of Entry Number, Date, and Value

- Tick on checkbox if Import is from SEZ

- Enter the taxable value based on the rate of tax applicable on the product imported

- Select whether the tax is eligible as ITC

Step 3 – Click on ‘SAVE’.

3. 4C – Import of Service:

This section is for services imported by you.

Step 1 – Click on ‘ADD DETAILS’.

Step 2 – Enter the following details:

- Invoice number, date, total value

- Select point of sale from the dropdown

- Enter the taxable value based on the rate of tax applicable

- Select whether the tax is eligible as ITC

Step 3 – Click on ‘SAVE’.

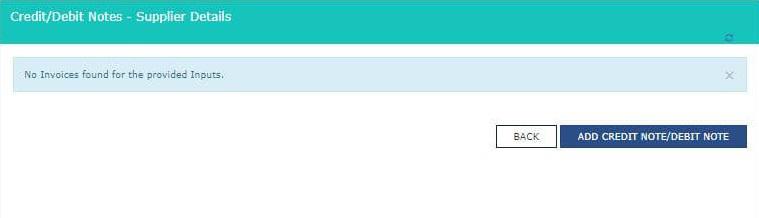

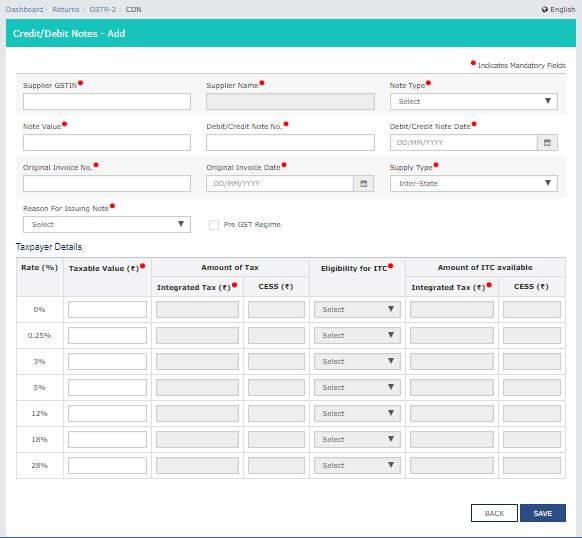

4. 6C – Debit/Credit Notes for supplies from a registered person:

Any debit note or credit note received from a registered dealer but missing in GSTR-2A should be entered here.

Step 1 – Click on ‘ADD CREDIT NOTE/DEBIT NOTE’.

Step 2 – Enter the following details:

- GSTIN of the Supplier

- Note type, value, number, date

- Original invoice number and date

- Supply type – inter-state or intra-state

- Reason for issuing note – sales return, post-sale discount, correction in the invoice, etc.

Step 3 – Click on ‘SAVE’.

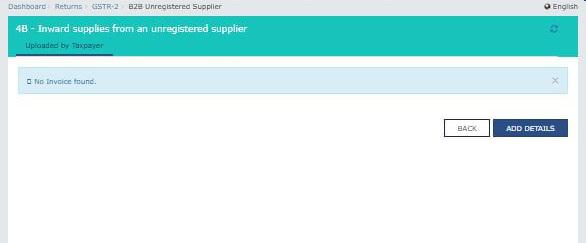

4B – Inward supplies from an unregistered supplier

Details of all purchase of goods and services from the unregistered supplier have to be mentioned in this section.

Step 1 – Click on ‘ADD DETAILS’.

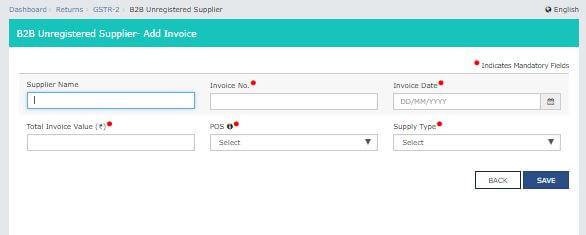

Step 2 – Enter the following details:

- Suppliers name

- Invoice number, date, value.

- Select point of sale from the dropdown

- Supply type – inter-state or intra-state

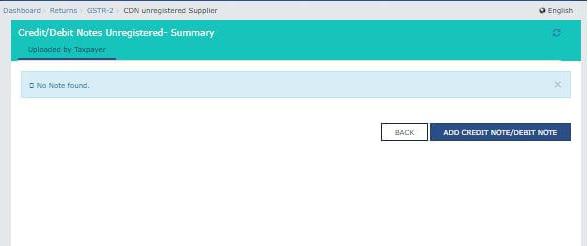

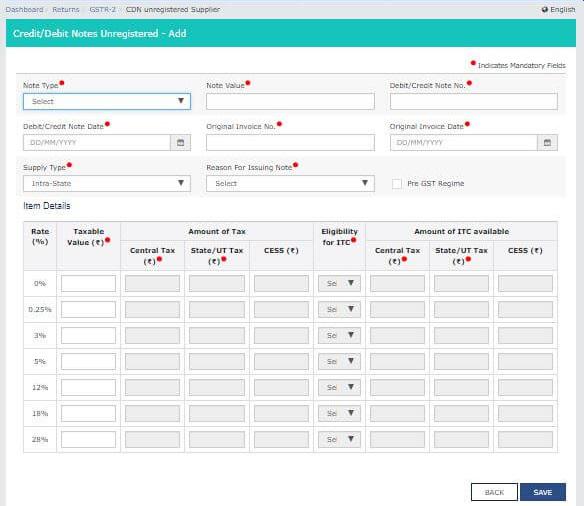

6C – Debit Notes/ Credit Notes for Unregistered Supplier:

Any debit or credit note issued for inward supplies from unregistered supplies has to be mentioned here.

Step 1 – Click on ‘ADD CREDIT NOTE/DEBIT NOTE’.

Step 2 – Specify the following details:

- Note type, value, number, date

- Original invoice no. and date

- Type of supply – Inter-state or intra-state

- Reason for issue of note

- Taxable value based on the GST rate

Step 3 – Click on ‘SAVE’.

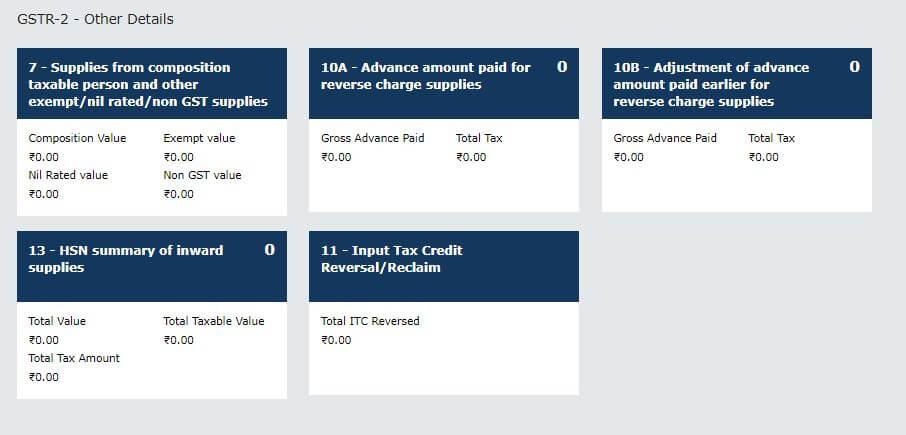

GSTR-2- Other Details

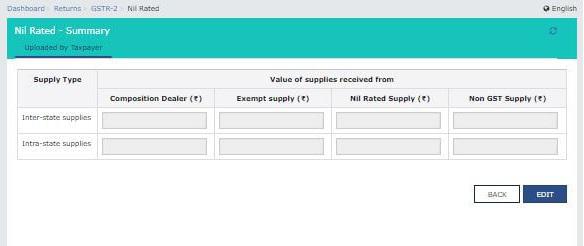

1. 7 – Supplies from composition taxable person and other exempt/nil rated/non-GST supplies:

Total inward supplies from composition dealers, and all inward supplies which are exempt and nil rated have to be entered here.

Click on ‘EDIT’, enter the values and click on ‘SAVE’ button.

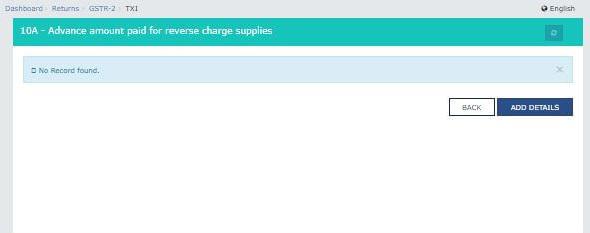

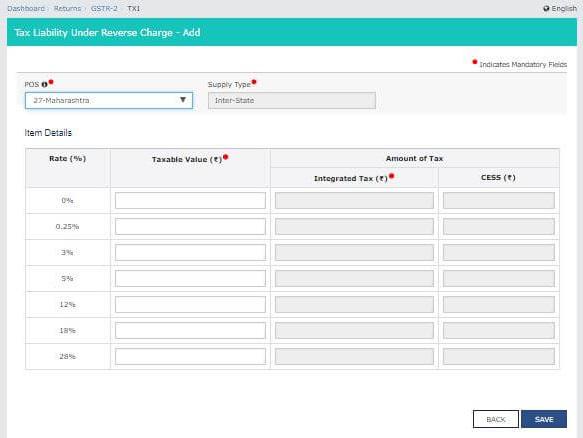

2. 10A – Advance amount paid for reverse charge supplies

All advances paid for

supplies liable to reverse charge have to be entered here. This will

increase your output tax liability as you are liable to pay tax on RCM

basis.

Step 1 – Click on ‘ADD DETAILS’.

Step 2 – Enter the Point of sale and the Taxable Value based on the GST Rate. Click on ‘SAVE’.

3. 10B – Adjustment of advance amount paid earlier for reverse charge supplies:

Any adjustments to be made to details mentioned in tile 10A in previous returns has to be done here.

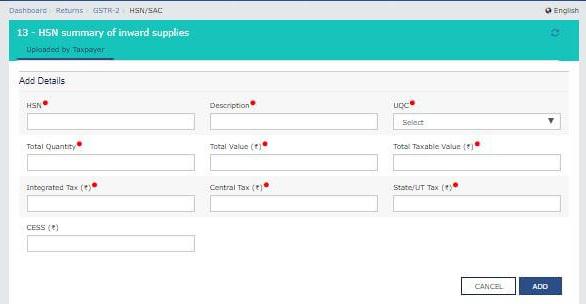

4. 13 – HSN summary of inward supplies:

HSN Code wise details of inwards supplies have to be provided while filing GSTR-2.

Step 1 – Click on ‘ADD DETAILS’.

Step 2 – Enter the following details:

- HSN Code, Description and Unique Quantity Code(UQC) of the inward supplies

- Total Quantity, Value, Taxable Value of goods/services

- IGST, CGST, and, SGST/UTGST paid on the supplies

Step 3 – Click on ‘SAVE’.

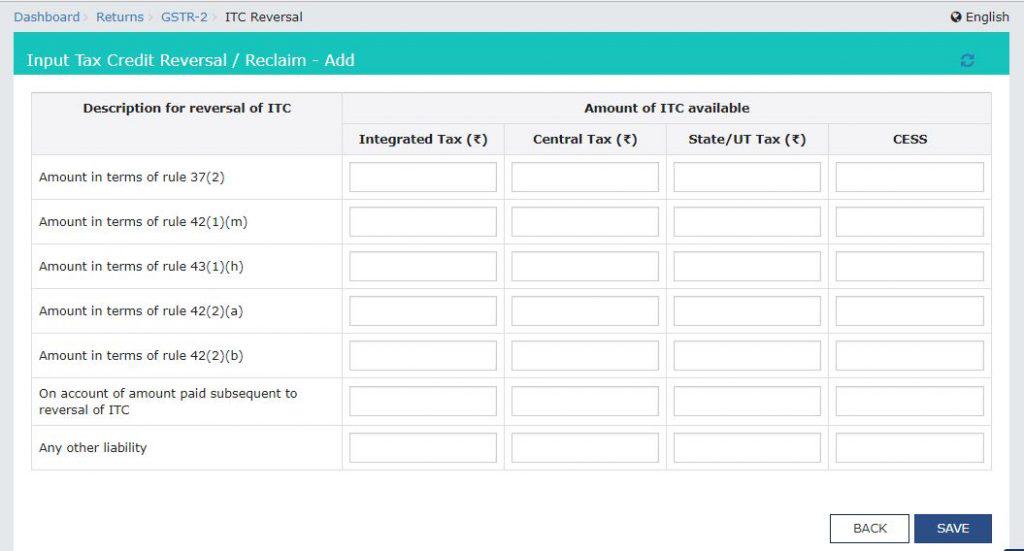

5. 11 – Input Tax Credit Reversal/Reclaim

There are certain conditions for claiming

ITC on inward supplies. If the same is not satisfied the ITC has to be

reversed. The details of ITC reversed have to be entered here. Click on ‘SAVE’ button after entering the details.

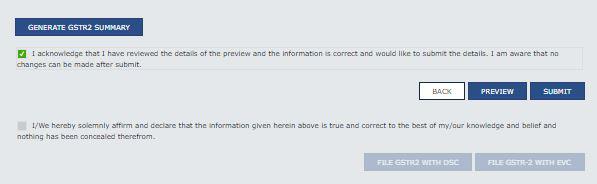

Final Step:

Once all the details have been entered the return a declaration is to be given and the return can be submitted online.

Check out this site to find GST Rate & HSN Code within 60 seconds, use this free calculator HSN Code Finder

ReplyDelete