Income Tax in India

Taxes in India can be categorized as direct and

indirect taxes. Direct tax is a tax you pay on your income directly to

the government. Indirect tax is a tax that somebody else collects on

your behalf and pays to the government eg restaurants, theatres and

e-commerce websites recover taxes from you on goods you purchase or a

service you avail. This tax is, in turn, passed down to the government.

Direct Taxes are broadly classified as :

- Income Tax – This is taxes an individual or a Hindu Undivided Family or any taxpayer other than companies, pay on the income received. The law prescribes the rate at which such income should be taxed

- Corporate Tax – This is the tax that companies pay on the profits they make from their businesses. Here again, a specific rate of tax for corporates has been prescribed by the income tax laws of India.

| 31 January | 31 March | 31 July | Oct – Nov |

|---|---|---|---|

| Deadline to submit your investment proofs | Deadline to make investments under Section 80C | Last date to file your tax return | Time to verify your tax return |

Income Tax Basics

Everyone who earns or gets an income in India is subject to income

tax. (Yes, be it a resident or a non-resident of India ). Also read our

article on Income Tax for NRIs.

Your income could be salary, pension or could be from a savings account

that’s quietly accumulating a 4% interest. Even, winners of ‘Kaun

Banega Crorepati’ have to pay tax on their prize money.

For simpler classification, the Income Tax Department breaks down income

into five heads:

| Head of Income | Nature of Income covered |

|---|---|

| Income from Salary | Income from salary and pension are covered under here |

| Income from Other Sources | Income from savings bank account interest, fixed deposits, winning KBC |

| Income from House Property | This is rental income mostly |

| Income from Capital Gains | Income from sale of a capital asset such as mutual funds, shares, house property |

| Income from Business and Profession | This is when you are self-employed, work as a freelancer or contractor, or you run a business. Life insurance agents, chartered accountants, doctors and lawyers who have their own practice, tuition teachers |

Taxpayers and Income Tax Slabs

Taxpayers in India, for the purpose of income tax includes:

- Individuals, Hindu Undivided Family (HUF), Association of Persons(AOP) and Body of Individuals (BOI)

- Firms

- Companies

Each of these taxpayers is taxed differently under the Indian income tax

laws. While firms and Indian companies have a fixed rate of tax of 30%

of profits, the individual,HUF, AOP and BOI taxpayers are taxed based on

the income slab they fall under. People’s incomes are grouped into

blocks called tax brackets or tax slabs. And each tax slab has a

different tax rate. In India, we have four tax brackets each with an

increasing tax rate.

- Income earners of up to 2.5 lakhs

- Income earners of between 2.5 lakhs and 5 lakhs

- Income earners of between 5 lakhs and 10 lakhs

- Those earning more than Rs 10 lakhs

| Income Range | Tax rate | Tax to be paid |

|---|---|---|

| Up to Rs.2,50,000 | 0 | No tax |

| Between Rs 2.5 lakhs and Rs 5 lakhs | 5% | 5% of your taxable income |

| Between Rs 5 lakhs and Rs 10 lakhs | 20% | Rs 12,500+ 20% of income above Rs 5 lakhs |

| Above 10 lakhs | 30% | Rs 1,12,500+ 30% of income above Rs 10 lakhs |

This is the income tax slab for FY 2017-18 for taxpayers under 60

years. There are two other tax slabs for two other age groups: those who

are 60 and older and those who are above 80.

A word of note: People often misunderstand that if they

earn let’s say Rs.12 lakhs, they will be paying a 30% tax on Rs.12

lakhs i.e Rs.3,60,000. That’s incorrect. A person earning 12 lakhs in

the progressive tax system, will pay Rs.1,12,500+ Rs.60,000 = Rs.

1,72,500.

Check out the income tax slabs for previous years and other age brackets.

Exceptions to the Tax Slab

One must bear in mind that not all income can be taxed on slab

basis. Capital gains income is an exception to this rule.

Capital gains are taxed depending on the asset you own and how long

you’ve had it. The holding period would determine if an asset is long

term or short term. The holding period to determine nature of asset also

differs for different assets. A quick glance of holding periods, nature

of asset and the rate of tax for each of them is given below.

| Type of capital asset | Holding period | Tax rate |

|---|---|---|

| House Property | Holding more than 24 months – Long Term Holding less than 24 months – Short Term | 20% Depends on slab rate |

| Debt mutual funds | Holding more than 36 months – Long Term Holding less than 36 months – Short Term | 20% Depends on slab rate |

| Equity mutual funds | Holding more than 12 months – Long Term Holding less than 12 months – Short Term | Exempt (until 31 March 2018) Gains > Rs 1 lakh taxable @ 10% 15% |

| Shares (STT paid) | Holding more than 12 months – Long Term Holding less than 12 months – Short Term | Exempt (until 31 March 2018)Gains > Rs 1 lakh taxable @ 10% 15% |

| Shares (STT unpaid) | Holding more than 12 months – Long Term Holding less than 12 months – Short Term | 20% As per Slab Rates |

| FMPs | Holding more than 36 months – Long Term Holding less than 36 months – Short Term | 20% Depends on slab rate |

Residents and non residents:

Levy of income tax in India is dependent on the residential status

of a taxpayer. Individuals who qualify as a resident in India must pay

tax on their global income in India i.e. income earned in India and

abroad. Whereas, those who qualify as Non-residents need to pay taxes

only on their Indian income.

The residential status has to be determined separately for every

financial year for which income and taxes are computed. Check your residential status on ClearTax.

Defining Income

Income has been very widely defined in the Income-tax Act. In simple

words, income includes salary, pension, rental income, profits out of

any business or profession, any profit made out of the sale of any

specified asset, interest income, dividends, royalty income etc. The law

classifies income under 5 major heads as already mentioned above.

- Salary Income

- House Property income

- Profits and Gains from Business or Profession

- Capital Gains

- Income from other Sources

The law also allows a taxpayer to claim deductions specific to each

such income and hence to avail the appropriate deductions, it is

important that you classify income under the right heads. Eg. A salaried

taxpayer can claim a standard deduction of Rs 40,000 while a taxpayer

having rental income from a flat can claim municipal taxes as a

deduction.

Income Tax deductions

There are broad themes to what the government incentivizes. These are either in the form of:

- Various deductions available under Section 80 of the Income Tax Act which can be claimed from the Total Income or

- Deductions that are specific to each source of income.

Some of the key deductions have been discussed here:

Home ownership

- Stamp duty and Registration under Section 80C

- Home loan principal and interest

- First time homeowner benefit of Rs.50,000 under Section 80EE

| Deduction on | Maximum allowed (for self-occupied house property) | Maximum allowed (for property on rent) |

|---|---|---|

| Stamp duty and registration + principal | Rs.1,50,000 within the overall limit of Section 80C | Rs.1,50,000 within the overall limit of Section 80C |

| Deduction on home loan interest under Section 24 | Rs.2,00,000 | No cap (but rental income must be shown in the income tax return) Further, maximum loss from house property capped at Rs 2 lakhs |

| Deduction for first-time homeowners under Section 80EE *certain conditions apply | Rs.50,000 | – |

Home renting

- House Rent Allowance or HRA (for salaried only) Given how many Indians move cities for work, this is a common allowance most salaried individuals can find in their payslips. If you are renting an apartment, be sure to claim this in your tax return.

- Section 80GG (if you are renting and don’t get HRA) If you are not salaried, or you are still salaried, but don’t get HRA, then you can claim deduction for rent under Section 80GG. Learn more.

Health

- Life insurance premium under Section 80C

- Medical insurance under Section 80D

- Preventative health checkups under Section 80D

- Medical bills (for salaried only)( replaced with standard deduction of Rs 40,000 effective 1 April 2018)

Tax Deductions for health insurance under Section 80D in FY 2017-18

| Person insured | Maximum deduction Below 60 years | Maximum deduction 60 years or older |

|---|---|---|

| You, your spouse, your children | Rs.25,000 | Rs.50,000 |

| Your parents | Rs.25,000 | Rs.50,000 |

| Preventative health checkup | Rs.5,000 | Rs.5,000 |

| Maximum deduction (includes preventative health checkup) | Rs.50,000 | Rs.1,00,000 |

Long-term savings

Employee provident fund (for salaried only)Companies cut 12% of your basic salary and put it in a fund managed by EPFO.Public provident fundIndividuals

can open a PPF account from a post office or a public sector bank like

State Bank of India and ICICI Bank. All of these allow you a deduction

under Section 80C upto RS 1.5 lakhsContribution to NPS is also another tax saving avenue for claim of deduction under Section 80CCD

Other investment avenues

| Investment | Risk | Interest | Guaranteed Returns | Lock-in Period |

|---|---|---|---|---|

| ELSS funds | Equity-related risk | 12-15% expected | No | 3 years |

| NSC | Risk-free | 7.6% | Yes | 5 years |

| 5-Year FDs | Risk-free | 7-9% expected | Yes | 5 years |

Business profits

Running a business and wondering how to go about your taxes? It is

simple. Take your gross receipts from your business and reduce various

business related expenses from it eg telephone, internet, salary you pay

to people you have hired, depreciation on the items that you use for

your business like computer etc. What you are left with are your profits

that you need to offer as your Income from Business.

Similar is the method of computing your taxable profits if you are

carrying out a profession too.

But make sure you maintain proper books of accounts recording all your

business transactions as law mandates that you do do. However, if you do

not want to maintain books, you may opt for Presumptive taxation scheme

where you will have to offer a fixed percentage of your gross receipts

as your income.

Read our detailed article onIncome from Business and presumptive income and taxes

Tax Credits

Income of certain nature will suffer a Tax Deduction at source

itself. Eg salary, interest, rent, commission etc. The person in charge

of paying such income will have to mandatorily deduct taxes before

making the payment subject to certain conditions. Similarly, one may be

liable to pay advance taxes if taxes payable after reducing TDS is Rs

10,000 or more. After TDS and advance tax, if there still tax to be

paid, the same would be paid in the form of Self Assessment Taxes.

All of the above taxes paid i.e. TDS, Advance Tax and Self Assessment

Tax would reflect in Form 26AS of the taxpayer which is a significant

document one needs to rely on while filing the return of income. This

Form 26AS is called the tax credit statement that contains all the tax

credits lying against you PAN for any given financial year.

Income Tax Rules

While the Income Tax Act, 1961 is the law enacted by the

legislature for governing and administering income taxes in India,

Income Tax Rules, 1962 has been framed to help apply and enforce the law

contained in the Act. Further, the Rules cannot be read independently.

They must be read in conjunction with the Act only. Further, the Rules

must be within the framework of the Act and cannot override the

provisions of the Act.

For example, the Act lays down the law with regard to taxability of

perquisites given by the employer to his employees as “salary”. However,

it does not discuss how the perquisites must be valued. Such valuation

is in turn prescribed under Rule 3 of the Income-tax Rules.

Income Tax Calculation

Every income that your receive should form part of your income tax

return. Of course, the law does provide for exemption of certain incomes

eg. dividend income from an Indian company, LTCG on listed equity

shares upto Rs 1 lakh in any financial year etc. Therefore, here is a

quick guideline you can probably follow to compute taxes due on your

income:

- List down all your income – be it salary, rental income, capital gains, interest income or profits from your business or profession

- Remove incomes that are exempt under law

- Claim all applicable deductions available under every source of income . eg claim standard deduction of Rs 40,000 from salary income, claim municipal taxes from rental income, claim business related expenses from your business turnover etc

- Claim all applicable exemptions under every head of income eg. amount reinvested in another house property can be claimed as exemption from capital gains income etc

- Claim applicable deductions from your total income eg the 80 deductions like 80C, 80D, 80TTA, 80TTB etc

- You will now arrive at your taxable income. Check the tax slab you fall under and accordingly arrive at your income tax payable.

The government keeps introducing and altering tax slabs, schemes

and tax benefits, so it’s a good idea to keep up with the Budget.

Income Tax Payment

The Government collects income tax from three channels:

- TDS

- Advance tax

- Self Assessment tax

TDS

- TDS exists to help government get tax throughout the year. There’s a prescribed table on how much tax deducted under what circumstances.

- Your employer cuts TDS based on the information available to him about you. So if you’ve made investments, but have not declared or if you live in a rented house, but have not shared rent receipts, your finance department will have no choice but to deduct tax based on only thing they know – your CTC.

- This is why the investment proofs deadline in your office is super important. Save yourself some headache and submit your investment proofs on time.

- Banks don’t know if you’re working in a company or if income from fixed deposits is what you solely rely on. So they deduct a standard 10% tax before they give away the interest. Now if you fall in the 20% or 30% bracket, it’s on you to pay the remainder of the income tax. That’s why sometimes you may find yourself paying some tax at the time of filing a tax return.

- Make sure banks have your PAN number. They deduct 20% tax if they don’t have your PAN in their records.

- Anyone who’s receiving an income of a specified nature say salary, interest, commission, rent, professional income etc. will have some percentage of tax withheld as prescribed by the government.

Advance Tax

Self-employed people must do the calculation themselves and pay the

tax to the Government periodically every quarter.The deadlines are:

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax |

| On or before 15th December | 75% of advance tax |

| On or before 15th March | 100% of advance tax |

To calculate your advance tax:

- Add up all the invoices received and include future payments you will be receiving till March 31 to estimate your taxable income.

- Deduct expenses directly related to your business, and any investments you have made under Section 80C in order to arrive at your taxable income.

- Determine your tax liability for the year

- Reduce the Tax already deducted at source from your tax liability as determined above

- If the remaining tax payable is greater than Rs 10,000 you will have to pay advance taxes based on the rates prescribed in the above table.

- Use the ClearTax Tax Calculator to determine your tax liability

Self Assessment Tax

When you are filing a tax return and you find out that you need to

pay additional tax, you’d be paying self assessment tax. Another way to

think about this would be.

- if you are paying tax for a financial year after the deadline has ended, you will pay self assessment tax.

- if you are paying tax for a financial year during the financial year, you will pay advance tax.

Payment of TDS Advance Tax and Self Assessment Tax:

TDS is deducted by the payer himself and remitted to the government

by him. Hence the taxpayer need not worry about this part of his tax

liability. As regards advance tax and self assessment tax, the same can

be discharged online using Challan 280. Read our detailed guide on payment of taxes online.

Income Tax Return

An Income Tax Return is a form where a taxpayer discloses details

of his income, claims applicable deductions and exemptions and taxes

that are payable on the taxable income. Further, details of taxes paid

also reflect in the return. Any excess tax paid for a year will be

claimed as a refund in the return of income.

Some taxpayers who are into any business or profession disclose

details of such business or profession like turnover, expenses relating

to business, profits from business etc.

All the above information, put together, form part of your return and is filed with the Income Tax Department

Income Tax Return Filing

Filing of income tax return online has been made mandatory for all classes of taxpayers barring few exceptions :

- Taxpayers aged 80 and above need not filed return online

- Taxpayers having an income less than Rs 5 lakhs and not claiming a refund need not file return online

For the rest, online filing is mandatory.

Do note that deadlines for filing of returns have also been prescribed.

For most individual taxpayers, the due date for filing return of income

is 31 July immediately following the concerned financial year. If you do

not file on time, here are some disadvantage:

- You will be denied carry forward of losses (except house property loss) to future years

- Delay processing of refund claims if any

- Difficulty on getting home loans

- Levy of late filing fee upto Rs 10,000 under Section 234F

- Levy of interest under 234A if there are taxes due as on 31 July

E-filing online is a more complete and better alternative to filing

on the income tax website. Also it is for more than just e-filing your

income tax return. ClearTax helps you claim all the deductions you’re

eligible for and helps you invest.

Once you file your return online, you either e-verify the same or

take a print of the ITR V and send it to CPC, bangalore for processing

of your return. Read our detailed article on e-verification of return of income

Here’s a guide to e-filing your first tax return on ClearTax.

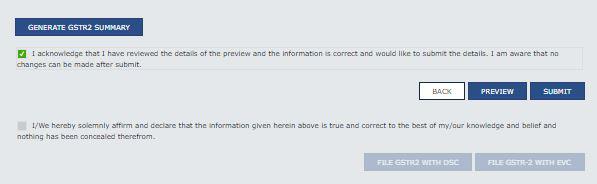

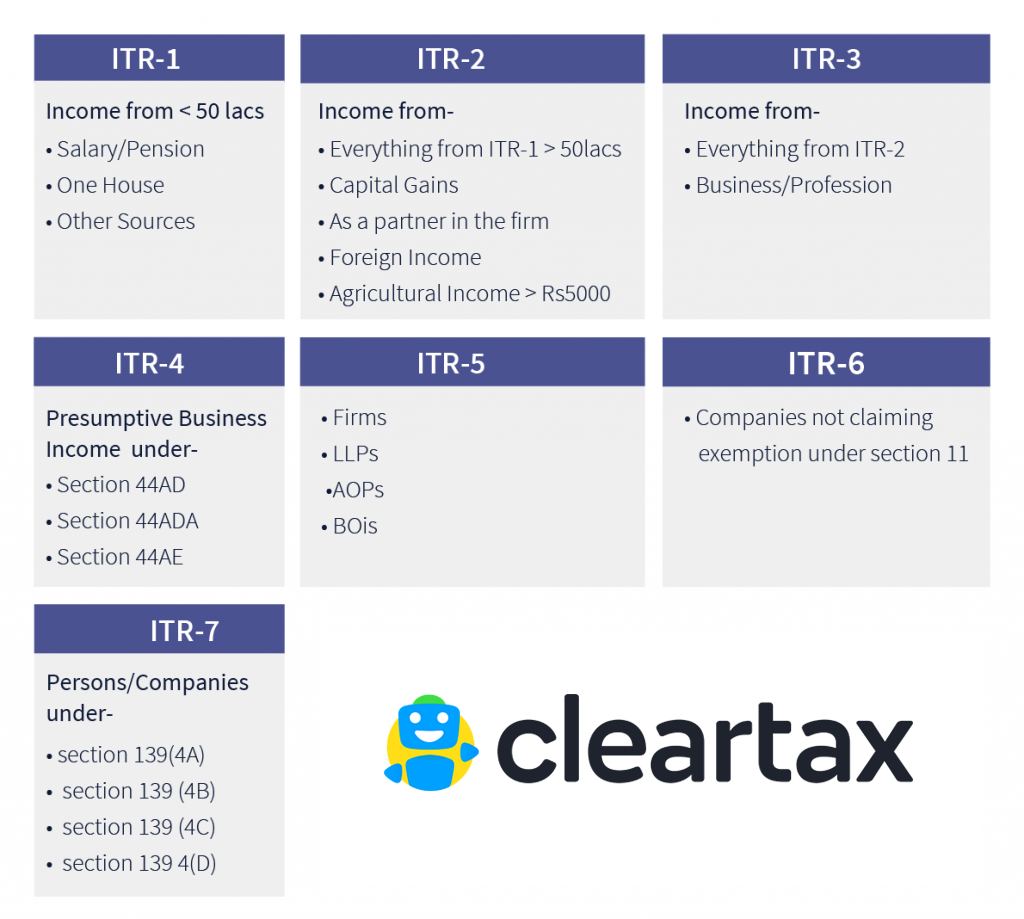

ITR Forms

ITR forms i.e. the return filing forms have been prescribed

differently based on the class of taxpayers and the source of income.

See below for further clarity

Documents Required for ITR Filing

Form 16, Form 26AS, Form 16A, proof of tax saving investments made,

bank account details etc are some of the crucial details / documents

that you need to be ready with before filing your return. Further the

documents you are going to need to file your tax return are largely

going to depend on your source of income. Here is our detailed article

on documents you need for filing of your return of income

Income Tax Faqs

-

When it is mandatory to file return of income ?It is mandatory to file return of income for a company and a firm. However, individuals, HUF, AOP, BOI are mandatorily required to file return of income if the income exceed basis exemption limit of Rs 2.5 lakhs. This limit is different for senior citizens and super senior citizens.

-

What are the maximum exemption limit and slab rates applicable for Assessment Year 2018-19 ?

Income Slab Resident and non-resident individuals Senior Citizens (Above 60 yrs but less than 80 yrs) Super Senior Citizens (Above 80 yrs) Upto Rs. 250,000 Nil Nil Nil Rs. 250,001 – Rs. 300,000 5% Nil Nil Rs. 300,001 – Rs. 500,000 5% 5% Nil Rs. 500,001 – Rs. 10,00,000 20% 20% 20% Above Rs. 10,00,000 30% 30% 30% -

Can i file return of income even if my income is below taxable limits ?Yes, you can file return of income voluntarily even if your income is less than basic exemption limit

-

What documents are to be enclosed along the return of income?There is no need to enclose any documents with the return of income. However, one should retain the documents to produce before any competent authority as and when required in future.

-

Should I disclose all my income in the return even if it is exempt?Yes. Income from every source including exempt income must be disclosed. The same can be shown under the Schedule EI.

Income Tax Tax Glossary

Form 26AS

Form 26AS is a tax summary statement that contains all the tax

payments you’ve made yourself (self-assessment tax/ advance tax) or tax

someone deducted (TDS) on your behalf. You’re going to need this

document when you are doing your income tax e-filing. Form 26AS can be

downloaded from www.incometaxindiaefiling.com

Form 16

If you need to know whether or not your company has given you some

tax allowance like your offer letter says, or want to see how much tax

has been deducted throughout the year, or need to see EPF contributions,

wouldn’t it be easier if you could see them all in one place? That’s

your Form 16.

Form 16 has:

- a summary of all the tax deducted by each quarter

- all the tax benefits and allowances you’ve availed as a salaried individual

- Section 80C deductions you’ve claimed through your employer

- and your taxable income after allowances and Section 80C deductions

This is a super important document for all salaried individuals.

And having a Form 16 makes e-filing your income tax return very simple.

You can upload your Form 16 and e-file your income tax return. No income

tax login required.

Form 16A

Form 16A is very similar to a Form 16 in that it contains how much

tax was deducted over what income. So how’s Form 16A different?Form 16A

will never be issued by an employer. They’re usually given to you by a

bank that’s deducting TDS, or a company that’s deducted tax on your

freelancing service.

Investment submission proof deadline

Depending on how large your company is, you might have two

deadlines related to investment proofs. There’s one in the beginning of

the year (April) that needs you to just declare how much money you’re

planning to invest in Section 80C. This will give an indication on how

much they need to deduct in TDS.Again in the last quarter (roughly

between December and February), you will be asked to submit investment

proofs. This is when you need to submit all your rent receipts, medical

bills (if you’re getting medical reimbursement), investments under

Section 80C, 80D.

Learn more about Investment submission proof deadline

Assessment Year/ Financial Year

Financial Year runs between April 1 and March 31 of each year.

Income tax is calculated for this period. Income tax returns are

assessed the year after the financial year has finished. So that’s your

Assessment Year. During the assessment year, taxpayers file their income

tax return. Income tax return and refunds are processed by the I-T

Department that year.

ITR-V

ITRV stands for Income Tax Return – Verification. After filing your

tax return online, you must print and sign a 1-page document and send

it to the Income Tax Department.

Challan 280

Challan 280 is the slip that you will use for online income tax payment.

Follow this guide to learn how to

pay tax due.This is the link to the Income Tax Department website. If you are a taxpayer, you’re going to need to use for:

- Getting your tax credit statement Form 26AS

- Getting your tax records for home loan or visa application

- Verifying your income tax return after ITR submission

Important Passwords

Here we have listed the most frequently downloaded documents and the format for the respective passwords.

To understand the application of these passwords better, let’s take an example

Rohan is a resident individual who has been filing his tax returns

for over ten years. His date of birth is 24.02.1988. Rohan’s PAN is

AAOPK0029P